Shopping search engine Shopzilla recently published a research showing that the “tablet revolution”, as online shopping via iPads and similar tablet devices is set to climb high in popularity, just as it has done in the US.

The research reveals that although the iPad was only launched 12 months ago, 6% of European shoppers already own a tablet and a further 20% are considering buying a device in the next year. The majority of owners said it was as easy to use for online purchases as a personal computer.

This trend is set to mirror the US where the iPad is driving a revolution in e-commerce. A recent US Shopzilla study showed that 12% of consumers now have a tablet device, and a further quarter plan to buy one in the next year. In the European survey, an overwhelming 5-to-1 ratio name the iPad as their tablet of choice.

The Shopzilla research was conducted in Europe’s three largest online retail markets: the UK, France and Germany. It also revealed that almost 80% of current tablet owners view their device as an addition to their technology arsenal rather than as a replacement for an existing device.

The research by Shopzilla of almost 5,000 online shoppers, also revealed:

– Nearly two thirds (61%) of iPad or tablet users said it was as easy to shop online with their hand-held device as it was with their personal computer;

– The majority, 71%, had bought or would buy online using their device;

– Dual-screen technology meant 70% of tablet users even watch TV while browsing shopping sites simultaneously, which is really interesting from a cross-platform marketing point of view;

– 53% of iPad or tablet users surveyed used their device to browse shopping sites and share shopping experiences with friends, showing that social shopping has extented its power in real life too;

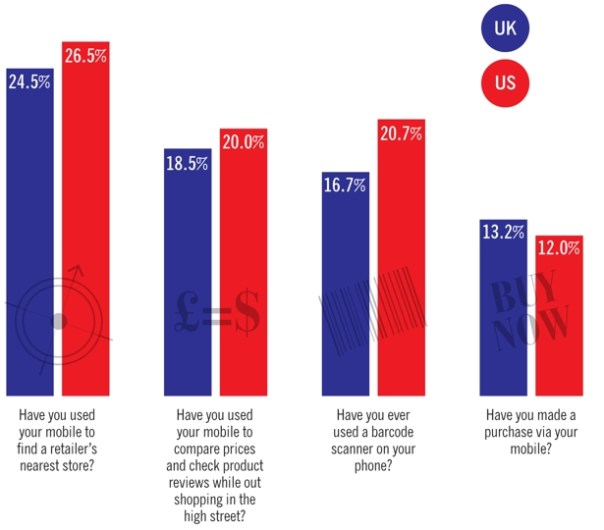

– 27% of online shoppers currently used a smartphone to browse shopping sites with friends

Rachel Smith, business services senior director at Shopzilla, said:

“Since their launch in April last year, an astonishing 25 million iPads have been sold worldwide, and with one in five online shoppers telling us they plan to buy a tablet in the next 12 months, this is clearly set to be a huge trend for UK shoppers.”

Smith added: “The year of mobile commerce, which has been predicted for some time, is finally here. With the explosion of the tablet market we are seeing a seismic change, and the opportunity will be for the retailers who are first to get it right.” (Source: The Retail Bulletin, image courtesy of The Belton Group)